Market

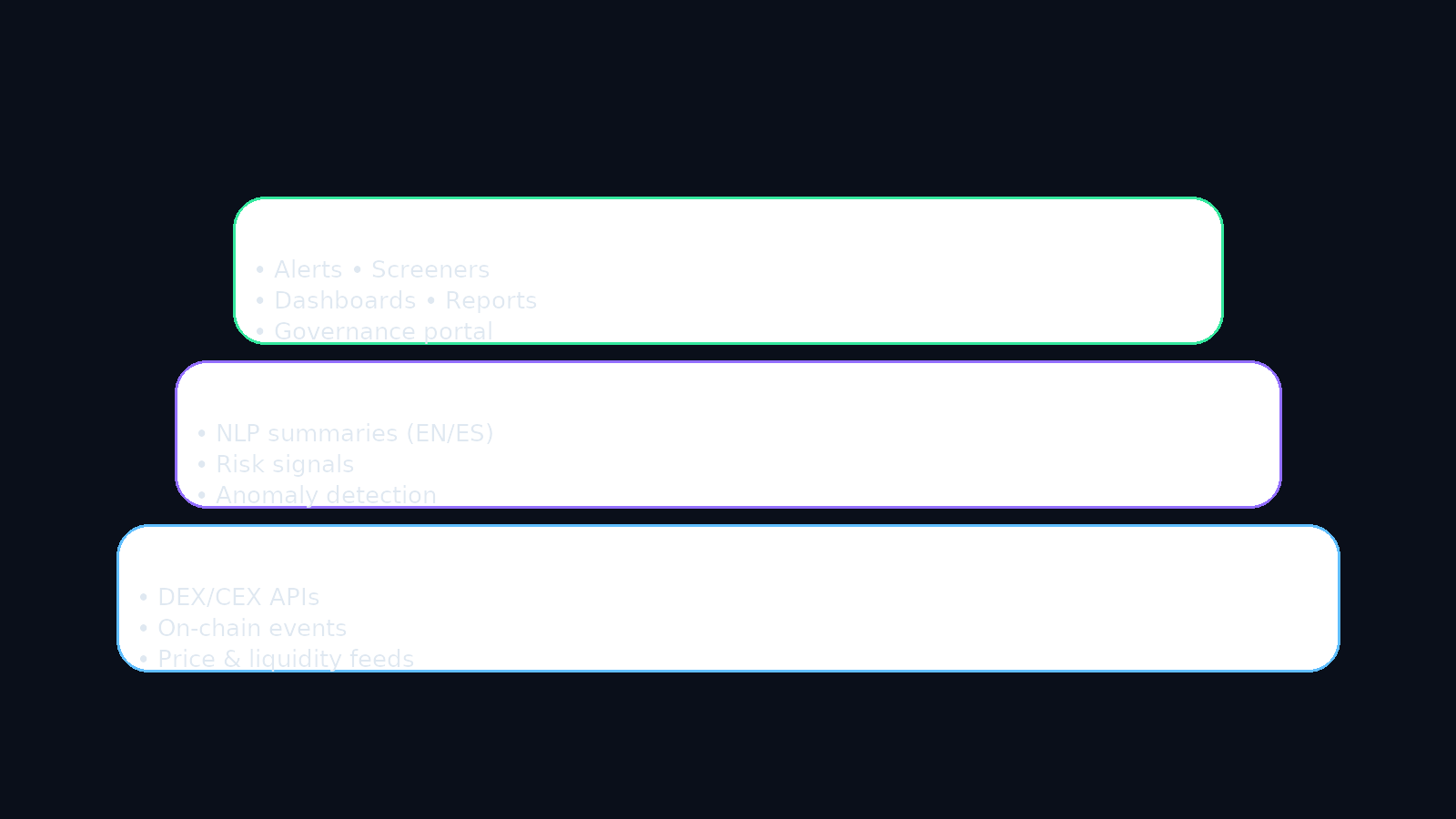

BLKDAI serves investors who need faster discovery, risk awareness, and multilingual research. We start with day-one utility (alerts, screeners, AI summaries) and scale toward an AI-assisted exchange, aligning value via a clear holder utility policy.

Thesis

- Crypto data is fragmented; workflows are slow. Investors need concise, multilingual context.

- Utility first: deliver measurable time-savings and better screening before incentives.

- Governed economics: fee changes require timelock + multisig; holder utility is revenue-aligned.

Buyer Personas

Active DeFi Trader

Needs rapid discovery and risk signals to act early.

Analyst / Small Fund

Requires disciplined screens and repeatable research notes.

Global Retail

Wants multilingual summaries and simple alerting UX.

Market Size Snapshot

| Scope | Definition | Relevance to BLKDAI |

|---|---|---|

| TAM | Broad crypto participants using data/tools across DEX/CEX. | Long-term ceiling for AI-assisted discovery and execution. |

| SAM | Active traders, analysts, and funds seeking signals and briefings. | Near-term monetizable users for alerts/screeners/briefs. |

| SOM | Initial cohorts reachable via content, partnerships, and communities. | Focus for V1 traction and unit economics. |

Note: Detailed sizing, assumptions, and references are available in the Data Room.

Positioning

- Focus: Signals that matter (liquidity/volatility/on-chain) + multilingual AI briefs.

- Policy: 0% fee at launch; governance-gated changes; public addresses/logs.

- Alignment: 20% holder utility funded by revenues/buybacks (no new issuance).

| Vector | Typical Tools | BLKDAI |

|---|---|---|

| Discovery | Screens, feeds | Signals + AI briefs |

| Risk | Manual checks | On-chain triggers |

| Language | EN-only | EN/ES summaries |

| Trust | Opaque | Governed, transparent |

Acquisition Channels

- Content: Research notes, dashboards, product demos.

- Communities: Collabs with trading groups and data forums.

- Integrations: Tooling ecosystems and data providers.

- Early-user programs: Usage-tied incentives with public metrics.

Partnership Priorities

- Market data providers (DEX/CEX), liquidity and price feeds.

- Messaging integrations (email/Telegram) for alerts.

- Governance and reporting stacks (dashboards, audit links).

Geographies & Compliance (Pragmatic)

- Clear Terms/Privacy and geofencing where applicable.

- Basic KYC/AML via a cost-effective provider for relevant flows.

- Public treasury policy; monthly disclosures and dashboards.

What We Measure

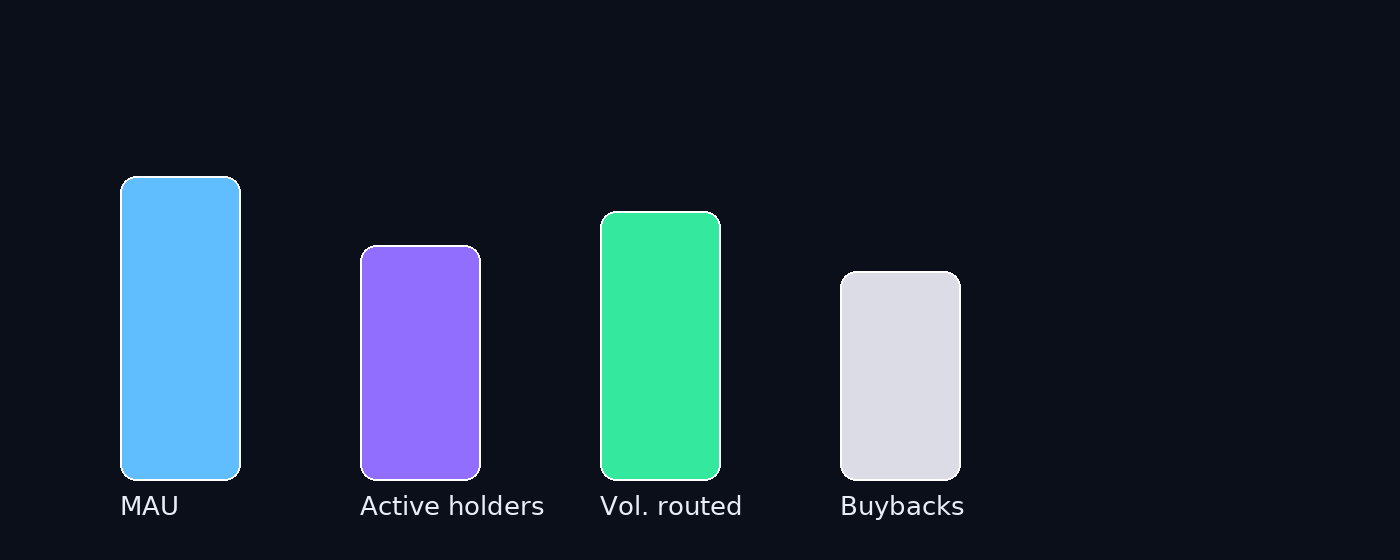

- Adoption: MAU, active holders, D30 retention.

- Economics: Routed volume, net bps, buybacks cadence.

- Product: Module usage, alert CTR, SLA latency.

Deeper market model available

Request the detailed sizing assumptions, cohort plans, and partnership pipeline in the Data Room.