Roadmap (no dates)

We ship in phases gated by clear acceptance criteria, not calendar dates. Each phase lists objectives, deliverables, KPIs, and dependencies so investors can track real progress.

Phase 1 — Relaunch & Utility v0

Foundation in place: relaunch, presale site, compliant docs, and initial product utility with BLKD Credits.

- Objectives: Credible relaunch, publish whitepaper & policy docs, deliver v0 modules.

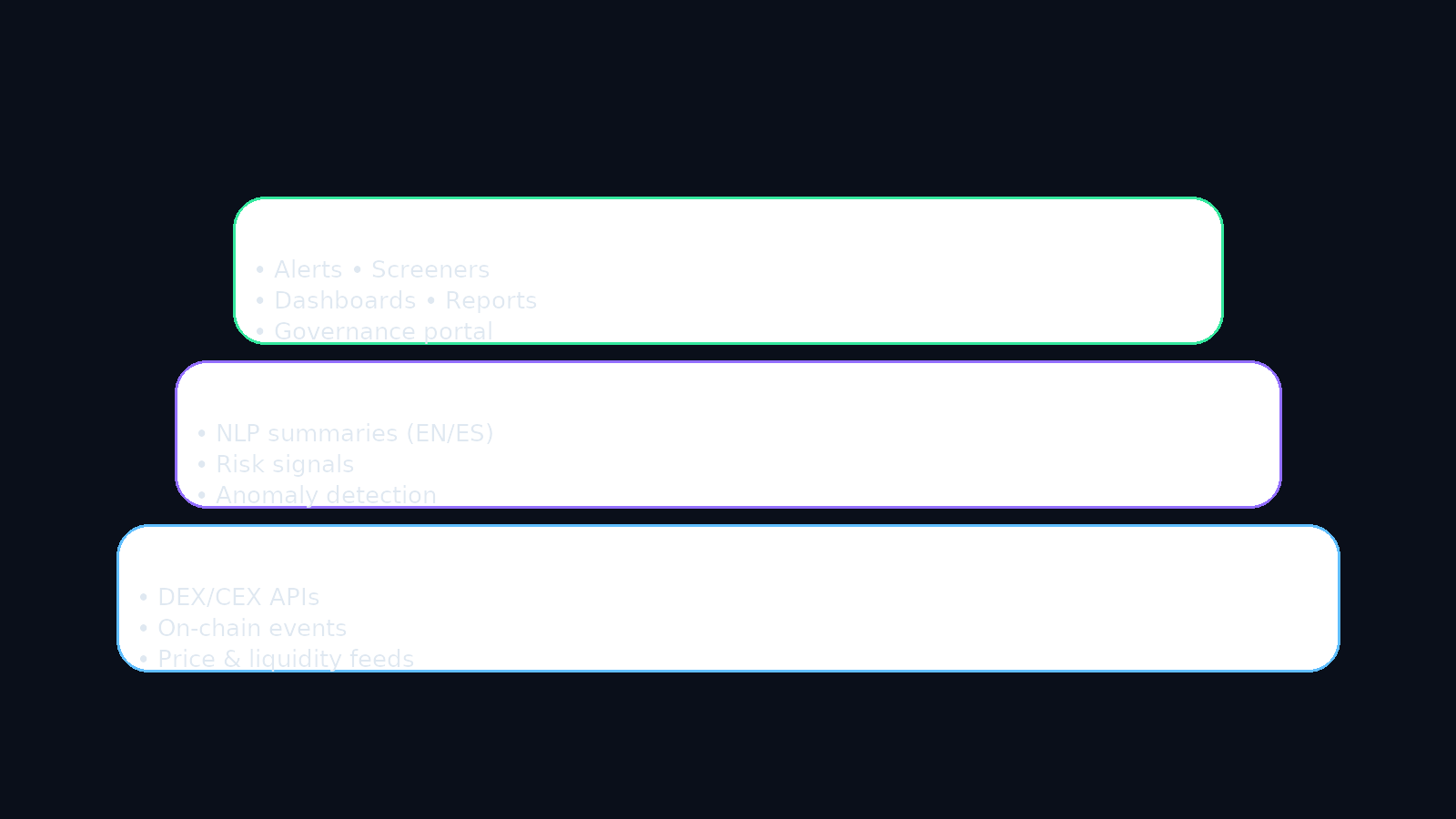

- Deliverables: Presale website, whitepaper, token contract verified, BLKD Credits, alerts, screeners, AI summaries (EN/ES).

KPIs

- MAU baseline established

- First cohorts onboarded

- Module usage tracked

Acceptance

- Token verified on-chain

- Addresses & logs published

- Unlock CSV posted to Data Room

Dependencies

- 2/3 multisig + timelock live

- Terms/Privacy & geofencing

- KYC/AML provider configured

Phase 2 — Terminal Growth

Expand modules, improve latency/SLA, and activate community governance signaling.

- Objectives: Increase daily active researchers, broaden data sources, refine UX.

- Deliverables: New screeners, richer alerts (on-chain anomalies), improved dashboards, governance portal.

- KPIs: MAU growth, D30 retention, alert CTR, SLA latency improvements.

Acceptance

- Public dashboards (usage & SLA)

- Monthly reports in Data Room

- Community signaling (off-chain) live

Phase 3 — Exchange MVP

Introduce AI-assisted routing, risk overlays, and listings readiness while keeping the token non-upgradeable.

- Objectives: Prove routing value; show measurable net bps capture.

- Deliverables: MVP routing, risk & NLP overlays, CEX/DEX integration path, market-making agreements (if applicable).

- KPIs: Routed volume, net bps, buyback cadence (revenue-aligned).

Acceptance

- Compliance checklist passed

- MM KPIs/signals documented

- Security controls reviewed

Phase 4 — Scale & Partnerships

Deepen liquidity, expand partnerships, and mature reporting & governance participation.

- Objectives: Expand distribution, improve economics transparency, strengthen resilience.

- Deliverables: More integrations, advanced dashboards, incident runbooks, insurance coverage (as applicable).

- KPIs: Active holders, governance participation, revenue quality, uptime.

Acceptance

- Quarterly “state of protocol” reports

- Transparency & change logs complete

- Resilience tests documented

Key Risks

- Market volatility impacts adoption and liquidity.

- Data feed disruptions or integration shifts.

- Regulatory changes affecting access or flows.

Mitigations

- Transparent treasury & runway policy; diversified reserves.

- Redundant feeds; graceful degradation; monitoring.

- Clear T&Cs, geofencing, pragmatic KYC/AML posture.

Milestone evidence on request

Unlock schedules, addresses, reports, and policies are available in the Data Room. We welcome diligence questions.