Token

A fixed-supply ERC-20 with governance controls from day one. Fee parameter is set to 0% at launch; any change requires timelock + multisig. On-chain vesting and public unlock reporting provide transparency.

Fixed

Total Supply

Non-upgradeable

ERC-20 Contract

0%

Fee at Launch

2/3 + 48–72h

Multisig & Timelock

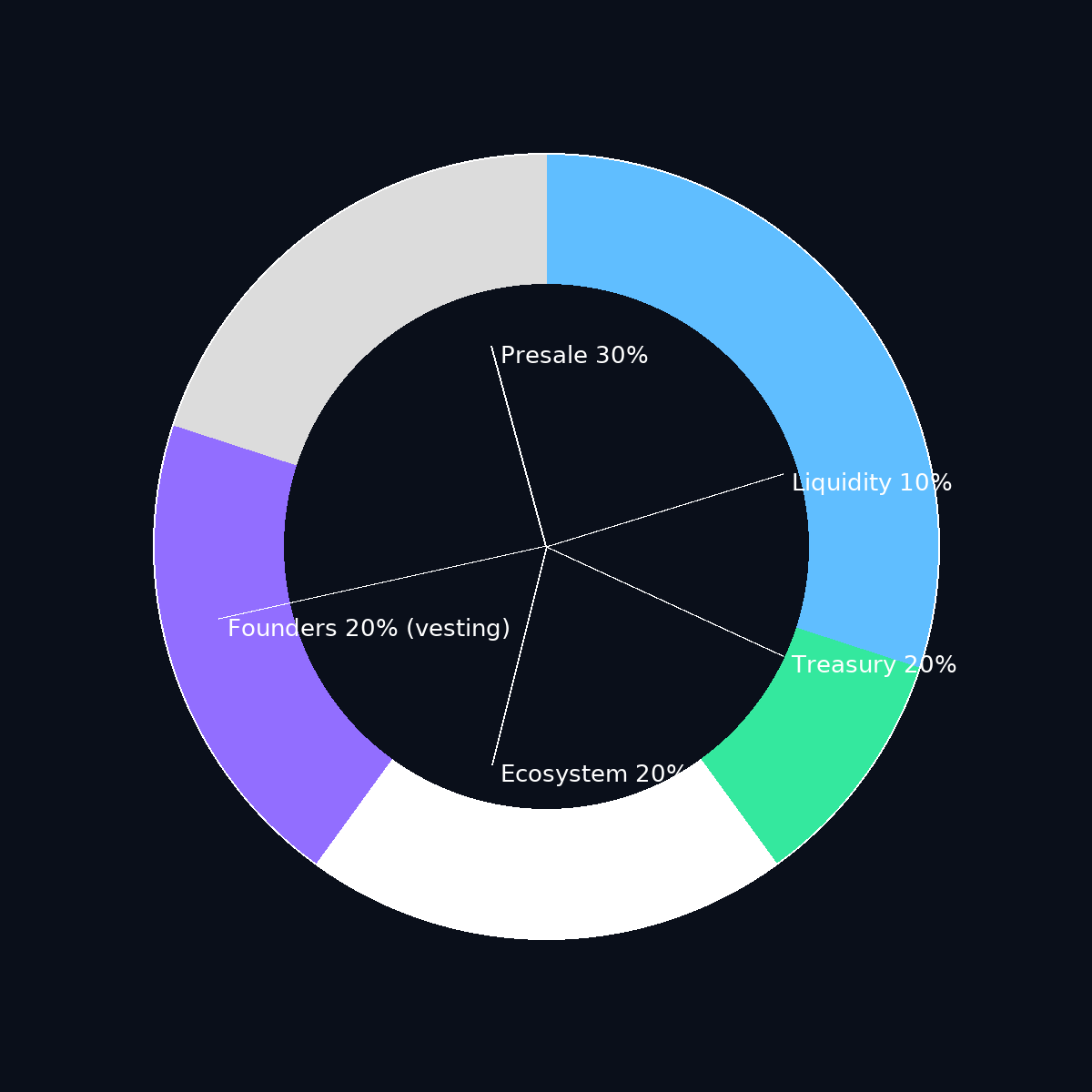

Supply & Distribution

- Fixed total supply (no mint function).

- Distribution: Presale 30% • Liquidity 10% • Treasury 20% • Ecosystem & Rewards 20% • Founders (vesting) 20%.

- Unlocks: On-chain vesting contracts; public schedule published in Data Room.

Economics & Policy

- Non-upgradeable ERC-20. Optional burn extension is policy-gated and disabled by default.

- Fee logic is deployed but set to 0% at launch. Changing fees requires timelock + multisig.

- Holder Utility (20%) funded from platform revenues or buybacks (no new issuance).

| Parameter | Default | Change Control | Notes |

|---|---|---|---|

| Transaction Fee | 0% | Timelock (48–72h) + 2/3 multisig | Any activation requires public notice and delay window. |

| Destinations | None at launch | Timelock + 2/3 multisig | Example: treasury, buyback program, ops wallet. |

| Burn Toggle | Disabled | Governance approval | Only after policy review and public notice. |

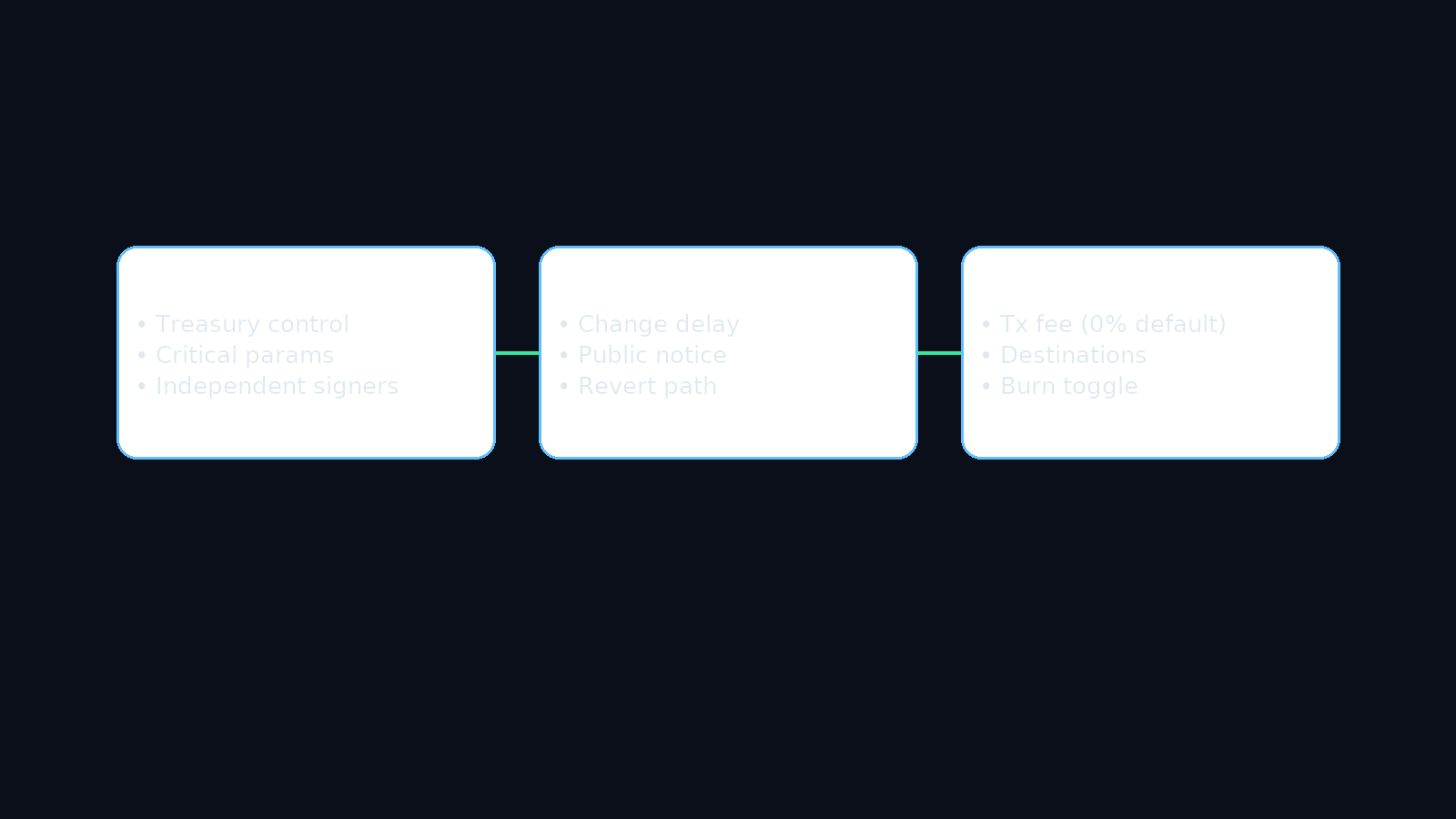

Governance & Controls

- Multisig (2/3): Independent signers; controls treasury and critical parameters.

- Timelock (48–72h): Delayed execution for changes with public visibility.

- Scope: Fee %, destinations, burn toggle; addresses published for verification.

Unlocks & Vesting

Team and advisor allocations are subject to on-chain vesting with cliffs; the unlock calendar is published for transparency. A downloadable CSV/Excel with all tranches will be available in the Data Room.

Addresses

- Token contract: Available in Data Room

- Multisig (treasury): Available in Data Room

- Vesting contracts: Available in Data Room

Audits & Policies

- Audit links and scopes: Available in Data Room

- Treasury, security, and incident policies: Available in Data Room

- Monthly reports & dashboards: Available in Data Room

It removes upgradability risk for the token itself. Governance controls only peripheral parameters (e.g., fee %, destinations) under timelock.

From platform revenues or buybacks. There is no additional token issuance for this purpose.

Only after public notice and the timelock period, with a 2/3 multisig approval. Fees default to 0% at launch.